Following the regular meeting of December 9, 2025, Casselman Municipal Council approved the 2026 budget, the result of several months of preparation and collaboration between Council, staff, and the community. This budget aims to maintain the quality of essential services, renew key infrastructure, and plan for growth responsibly, while respecting taxpayers’ ability to pay.

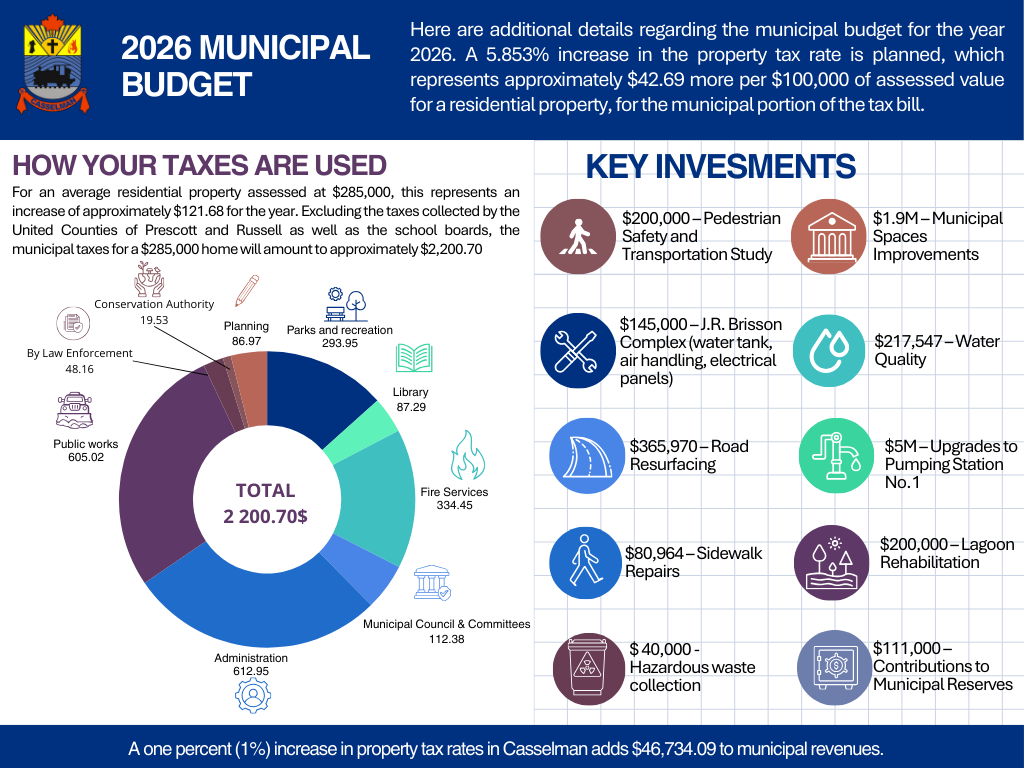

The adopted budget includes a municipal increase of 5.853%, which represents $42.69 per $100,000 of assessed value. For an average residence assessed at $285,000, the estimated annual impact is $121.68, or approximately $10.14 per month for the municipal portion of the tax bill. These amounts exclude the shares from the United Counties of Prescott and Russell (UCPR) and the school boards, which are set separately.

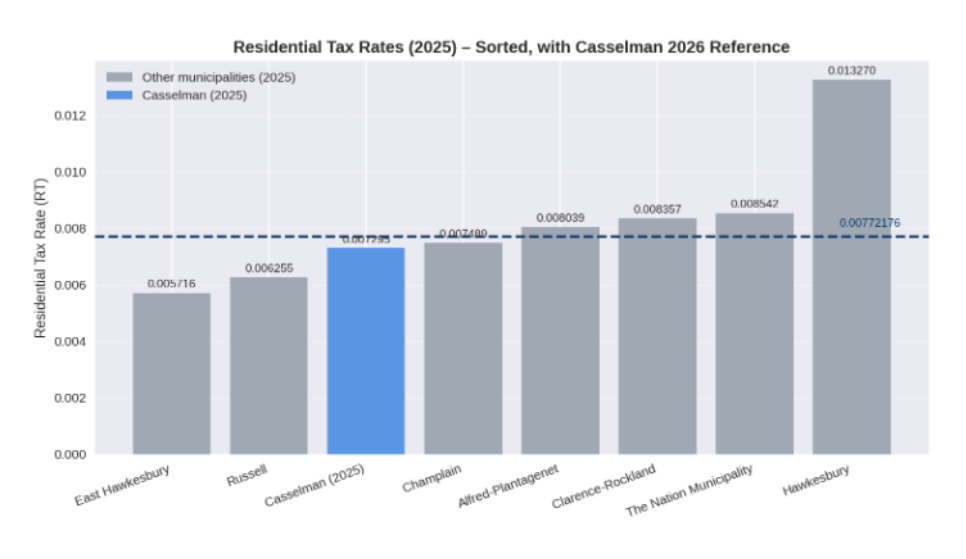

Even with the proposed 5.853% increase to the residential tax rate for 2026, Casselman remains in the middle range of municipalities within the UCPR. The revised rate of 0.00772176 remains lower than the 2025 rates already in effect in various UCPR municipalities. In other words, despite the proposed adjustment, Casselman continues to position itself within the regional average for residential tax rates.

A Transparent and Rigorous Budget Process

The budget preparation process unfolded over several stages. First, each municipal department identified its operating needs (salaries, maintenance, contracts, regulatory compliance) and capital needs (roads, buildings, water/sewer, equipment), based on the Asset Management Plan and established replacement schedules. The administration then consolidated these needs into scenarios, adjusted economic assumptions (inflation, contracts, grants), and calculated the corresponding tax impacts, including the effect of a one‑percentage‑point variation on municipal revenues (one percent—1%—increase in the property tax rate adds $46,734.09 to municipal revenues).

Public information and participation activities helped gather residents’ priorities and integrate targeted requests, particularly regarding pedestrian safety and community planning. The first budget meeting began with a scenario involving an 18.70% tax rate increase. Council then progressively reduced and/or eliminated several projects and initiatives in order to establish the tax rate of 5.853%.

Following Council working sessions, the final version of the budget reflects balanced decisions that protect services, maintain municipal assets responsibly, and support prudent long-term planning.

Planned Investments for 2026

In 2026, the Municipality will focus its investments on projects that sustainably improve quality of life and strengthen infrastructure resilience. Priority initiatives include resurfacing several streets and rehabilitating sidewalks along segments identified as high‑priority; upgrades at the J.R. Brisson Complex to modernize critical mechanical and electrical components; and major investments in water quality, including reducing manganese and trihalomethanes (THMs), upgrades to the pumping station, and rehabilitation of the lagoons.

The construction of the new Town Hall, located at 1 Industriel Street, is progressing to deliver a modern and functional building designed to meet the municipality’s anticipated growth and to provide reception and workspaces compliant with the Accessibility for Ontarians with Disabilities Act. At the same time, the municipality is managing additional costs related to corrective work for water infiltration discovered in 2023 following the acquisition of the building.

To respond to community requests related to mobility and safety, a Transportation and Pedestrian Safety Master Plan study is planned for 2026. This study will help better prioritize future interventions, strengthen pedestrian safety, and support the long‑term planning of transportation networks.

In addition, to respond to a recurring request from residents, the Municipality will hold a hazardous waste collection day in 2026. This new initiative aims to facilitate the safe disposal of problematic materials and to encourage sound environmental practices. Residents are invited to stay tuned for more information that will be shared in the coming months regarding this activity.

Financial Reserves: Planning and Smoothing Future Costs

To support long‑term planning and avoid sudden tax increases, the Municipality will contribute a total of $111,000 to its reserves in 2026. These amounts are allocated as follows:

- $66,000 to the Fire Services Reserve, in anticipation of the eventual replacement of the ladder truck and the air compressor.

- $25,000 to the Asset Management Reserve for the building at 750 Principale Street, to ensure proper maintenance and lifecycle‑based upgrades.

- $20,000 to the reserve for the future purchase of a snow plow truck, in alignment with the Municipal Asset Management Plan.

Monitoring, Accountability, and Public Information

Residents are encouraged to consult the 2026 municipal budget to learn more about planned investments and key financial highlights. In addition, an operational report is published every quarter to keep residents informed about the progress of all ongoing projects. Citizens may also review documents and ask questions during regular Council meetings.

Overall, the 2026 budget enables Casselman to strengthen its services, safeguard its infrastructure, and rigorously plan for future needs. Through responsible management, data‑driven planning, and ongoing collaboration between Council, administration, and the community, the Municipality continues to move forward on a stable and sustainable path. Residents are encouraged to remain engaged in this process and to regularly consult the information tools available to them to follow project progress and the evolution of municipal finances.